To enable institutional traders to instantly recognize market shifts, capitalize on fleeting opportunities, slash execution costs, and maximize trading edge—backed by deployments across leading global financial institutions.

AI-first design: Deep learning, NLP, and knowledge-graph algorithms unlock real-time insights from unstructured data. Smart execution: Proprietary signals and dynamic dashboards empower traders with instantaneous data-driven intelligence.

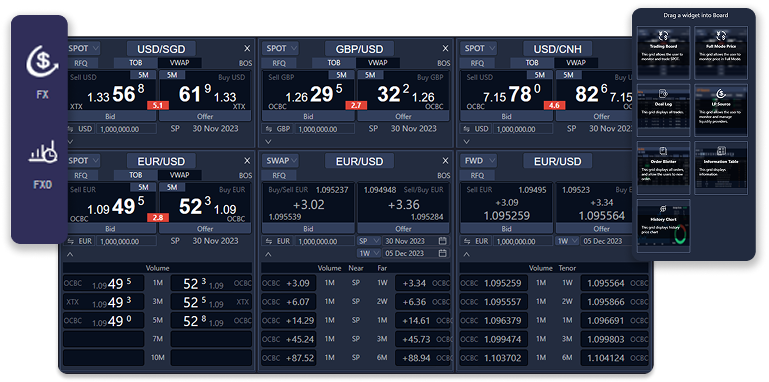

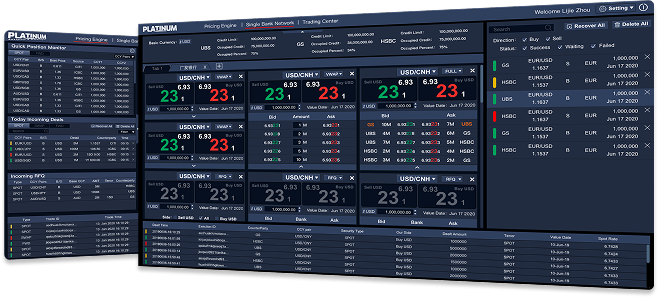

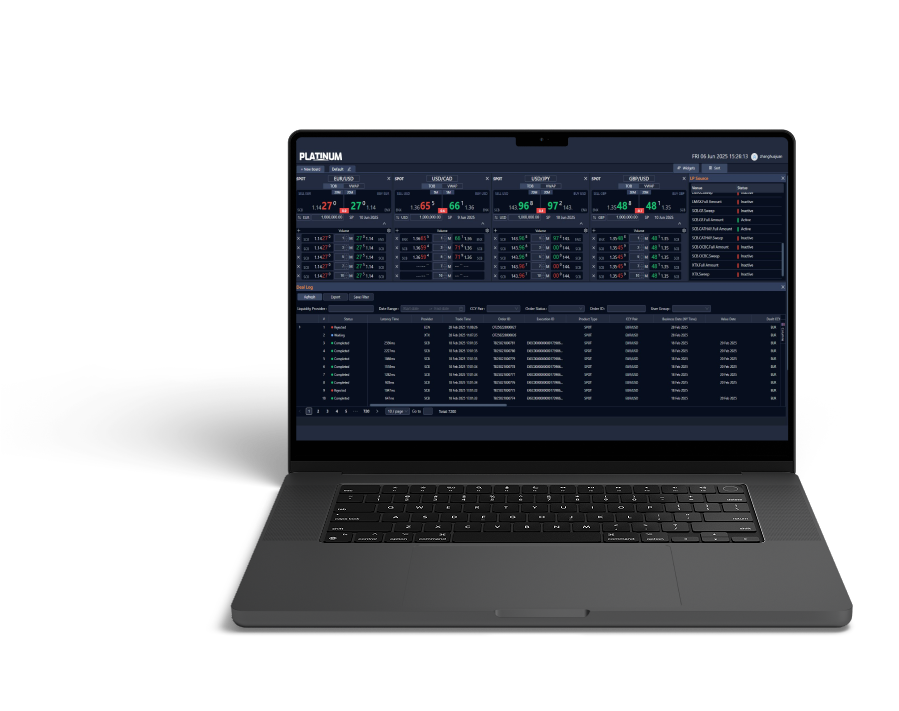

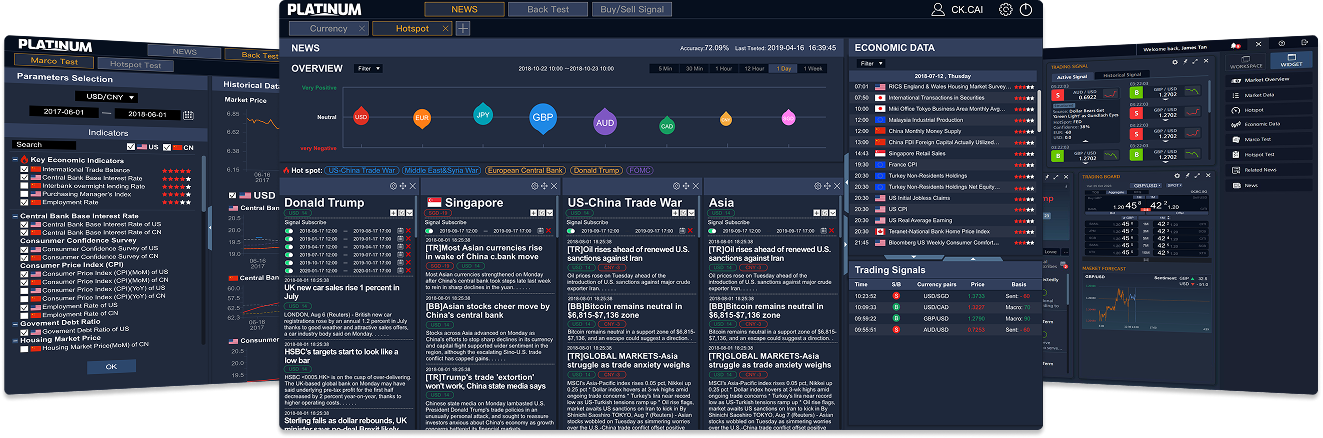

PATS Whitelabel is an advanced trading analytics platform developed by PLATINUM, empowering traders through cutting-edge quantitative tools and big data technologies. The system integrates sophisticated algorithms with real-time market data processing capabilities to deliver actionable market insights, enabling users to efficiently analyze complex market conditions and optimize investment decisions. Featuring a dynamic and customizable interface, the platform supports cross-device flexible data visualization, allowing traders to seamlessly monitor key indicators, track liquidity patterns, and execute trading strategies. It caters to both institutional investors seeking competitive advantages in forex and multi-asset markets, as well as individual traders. Its adaptive display technology intelligently prioritizes critical information based on market volatility and user preferences, providing a robust solution for modern electronic trading environments.

Platinum Analytics is serves clients with professional LP/LC trading terminals, including

Pricing EngineMarket Data Aggregation & ModelingSmart Order RoutingAlgo-Tradingand new features to help traders grasp real-time market conditions, seize the opportunity to trade, reduce transaction costs and improve trading efficiency.

Platinum Analytics also provides

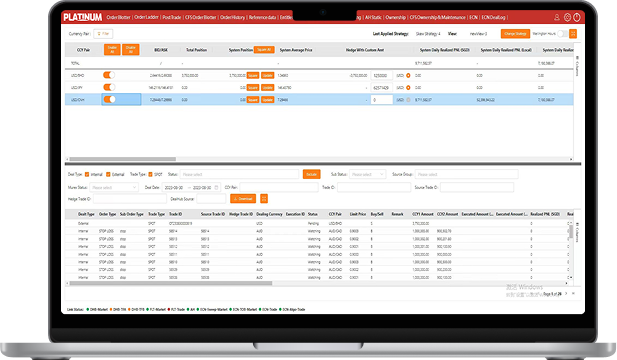

Volatility ForecastingData Delay MonitoringAuto Market MakingAuto Back-To-Back HedgingReducing Trading RiskEnhancing Trading CapabilitiesOur LP/LC is closely integrated with PATS ECN and News Analysis System to create an integrated and smooth trading experience.

Order Management System is closely integrated with Auto Hedging System, providing an integrated platform for auto-trading and risk control.

Based in Singapore, Platinum Analytics has works with top liquidity providers covering both Asia and Europe markets.

With advanced network infrastructure, PATS ECN provides high guarantee and low latency all-day trading experience.

PATS ECN provides full market depth with high liquidity, focusing on offshore CNH, and covering EM currencies and traditional G7.

As the first overseas ECN platform with Chinese background, PATS ECN uniquely positions to serve Chinese clients in a holistic manner.

Traders get timely financial information from major news sources with millisecond-level data filtering, processing, and display. The system adopts deep learning on multi-dimensional news analysis, generating sentiment scores, and predicting FX trends with visualization of market opinions.

Historical data analysis of economic indicators and news buzzword provides statistical-based analysis tools for the analysis of economic indicators in the FX market, and truly reproduces the actual profit, risk, maximum drawdown, etc.

The system makes comprehensive prediction on market trends from different perspectives and generate real-time trade signals available, responding to milli second level movement and second-level decision-making needs.

Master of Engineering, University of London

Served as marketing director of Comstar at CFETS, senior account manager at Tomson Reuters; worked for Dow Jones Telerate, and strategic department & electronic banking center of UFJ China.

Bachelor of Engineering, University of Michigan

Managed Trading Solutions for Thomson Reuters as expert in FX algo & auto trading, covering European / American / APAC. Designed and implemented multiple sets of high-frequency auto trading & risk control solutions; implemented Reuters NewsScope for FX market.

MBA, Shanghai Jiao Tong University

With over a decade of experience in financial management and investment analysis, he has served as CEO at Shanghai Tou Chang Investment & Management and led the finance department at Wanguo Constructions and Project Management Ltd. His background includes extensive expertise in equity investment and corporate financial operations.

Bachelor of Commerce, Curtin University of Technology

Launched Citi's flagship eCommerce platform, PM & sales for Asia from inception till v2.0. Worked at Bloomberg as account manager and later run Trading Systems team for South East Asia.

Bachelor of Science in Economics (Honours), University of London

Prior to joining Platinum, Leslie has had over 20 years of experience as a trader with UOB, he was last Head of Trading for the bank till 2017. He was also a board director of CLF Group Holdings AG and CLS Bank International from 2016 to 2017.

Masters of IT in Business, Singapore Management University

Worked as a Quantitative Analyst with multi-asset class hedge funds, focused on developing alpha strategies and managing multi-asset class portfolios. Skilled in applying data-driven models and statistical techniques to support investment decisions and enhance performance.